Rollover Traditional 401(k) to Roth IRA

As Americans continue to be inundated with the COVID-19 pandemic, many can’t help but look at their 401(k) plan and ponder what to do. From an investment standpoint, financial professionals are consistently preaching long-term investing practices and for investors to not panic by selling stock positions during a valley. Many investors may be pondering how they can possible take advantage of the current bear market?One option that does deserve a look is the concept of an in-plan 401(k) Roth conversion.

Everyone that has saved for a retirement plan has chosen what type of tax advantaged vehicle to use, traditional pre-tax contributions or after-tax Roth contributions.

Pre-tax deferrals allow plan participants to defer income taxes now until withdrawing dollars in retirement. The idea is that the tax bracket during your golden years will be less than now and to reduce one’s current taxable income. Additionally, contributing pre-tax allows participants to invest more money to realize the same take home pay amount; money that would be deducted to pay taxes from Roth contributions can be contributed directly to the 401(k) plan. Roth contributions do require income taxes to be paid upfront, however the benefit is that both the principle amount and all subsequent investment earnings are tax free once you reach age 59 and have held the account for at least five years.

What is an In-Plan Roth Conversion?

A Roth conversion is when you move funds from a traditional pre-tax deferral account source to a Roth account source. When you do the conversion, the amount will be considered earned income for the year and taxed according toby your tax bracket. Outside of the tax obligation, there are no additional excise penalties that would apply. Once your savings are considered Roth, any principle and investment earnings will grow tax free. You can perform a Roth conversion in either a 401(k) plan or IRA.

Why is Now a Good Time to Look at a Roth Conversion?

As many retirement savers are seeing their 401(k) accounts balances decline during the pandemic, now would may be an optimal time to take advantage of the lower balances by converting to Roth and paying less taxes. As an example, if your account balance was $100,000 prior to the market decline and now is at $70,000, that is a $30,000 less in taxable wages that you would have had to pay for.decrease in tax liability. Taking it a step further, and assuming a 25% effective income tax rate, converting to Roth now that would save you $7,500 in taxes. Furthermore, your entire balance will now grow tax-free, putting you in a better financial position when the market recovers than you were previously. and you would never have to pay taxes on those savings ever again.

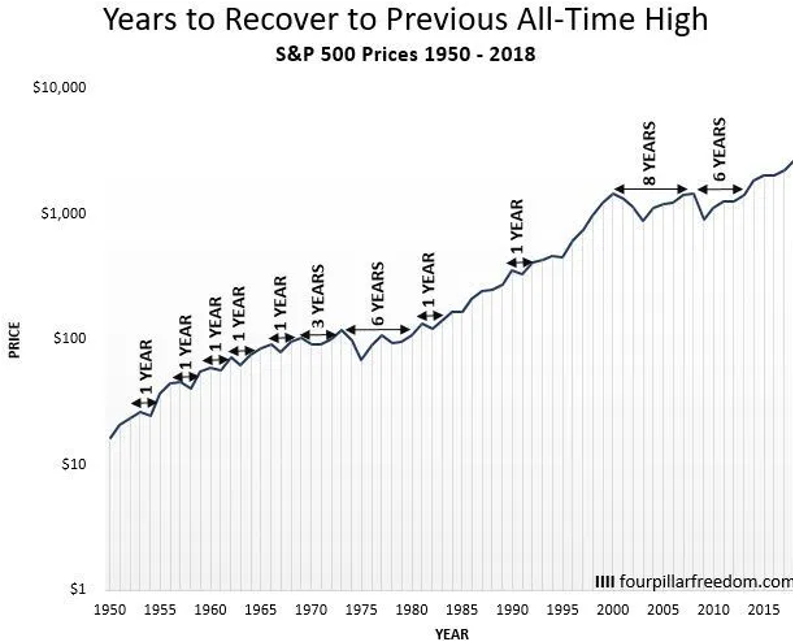

The biggest factor when deciding whether, you should be contributing to a Roth vs Pre-tax is time horizon. If you are looking at 20, 30, or more years until retirement and needing these investments, it is very hard to beat 20, 30 ,or more years of tax-free investment earnings. If closer to retirement, one thing to keep in mind during this bear market is historically how quickly the stock market rebounds.

The max drawdown of the S&P 500 during the Great Recession of 2008 was 55.25% which occurred over a period of 18 months. (Max drawdown is expressed by the difference between the prior highest peak of the S&P 500 to its lowest valley). What happened in the aftermath of the Great Recession was the largest bull market in American History. In the 11 years since the infamous 2008, all but one year saw a rise in the S&P 500 index. Think about if your retirement savings were classified as Roth dollars and every year except 1 resulted in a positive rate of return; with both principle and earnings being. All tax-free in retirement.

2019 | 31.49

2018 | -4.38

2017 | 21.83

2016 | 11.96

2015 | 1.38

2014 | 13.69

2013 | 32.39

2012 | 16

2011 | 2.11

2010 | 15.06

2009 | 26.46

2008 | -37

What to Think About when Contemplating a Roth Conversion

By far the biggest implication of converting traditional pre-tax retirement deferrals to Roth is going to be the immediate tax obligation. Going back to the $70,000 example and the assumed effective income tax rate of is 25%, that would result in an overall tax liability of $17,500 that must be addressed. That is certainly not a number that most people have readily available to pay out of pocket as you would not be able to use retirement savings to assist. The other thing regarding taxes that you will need to be cognizant of is that the amount you would convert is added on as earned income for the year and very well could raise your income tax bracket for both State and Federal.

All vested qualified retirement pre-tax savings are eligible for Roth conversions. For traditional IRA accounts, that process is very straight forward, and you should be able to find out the process from your provider. For 401(k) plan’s, even though the IRS allows for all plans to have an in-Plan Roth conversion option, it is ultimately up to each Plan Sponsor to include in the elect this provision in the plan document. Plan sponsors for retirement plans should be able to contact their provider and determine if the option is currently available and if not, how to amend the plan document to include.

If thinking about doing a Roth conversion of your traditional pre-tax retirement savings, some things to keep in mind include:

The dollar amount converted would be considered earned income for this year.

Retirement savings would then grow tax free with investment earnings.

Need to be invested in a Roth account for at least 5 years from first contribution and be age 59 ½ to receive the tax-free treatment.

Protection in the event income tax rates are raised 20 or 30 years from now during your retirement.

The average 401(k) investor is always going to be holden to the stock market as it has been historically been the greatest avenue to generate investment earnings. This market downturn is not the first and won’t be the last and staying the course on your overall investment strategy will always be the best course of action. When looking for a way to benefit from the current trough, a Roth Conversion is something that is controllable and if used and timed properly, could put you in the driver seat to reach goals to have the dignified retirement that everyone aspires to.

With a decision of this magnitude it is advisable to talk with your tax-preparer and financial planner to determine the short-term and long-term implications with a Roth conversion strategy.