Payroll Integration with LT Trust

Full Integration. Your Workday. Your Way.

LT Trust is excited to announce the immediate availability of our payroll processing service with industry-leading payroll providers! Our payroll integration system and payroll assist services were designed to take the headache out of the human resource payroll process.

Many companies overlook payroll processing when picking their 401(k) provider. Without the LT Trust payroll integration platform, employers are responsible for maintaining deductions, tracking eligibility, and manually entering employee data. This is not only time-consuming for HR but can also cause errors and ultimately more problems in the end.

If you have any questions, don't hesitate to contact us online or call us at (833) 458-4015 and an expert at LT Trust will be happy to help.

The Importance of Payroll Integration

True payroll integration helps 401(k) record-keepers and third part administrator "TPAs" stay ahead of the competition by providing their clients with plug-and-play data integration solutions. Processing payroll is more important today than ever before. Companies that struggle with tracking, storing, and protecting their employees' data may find that payroll integration reduces the burden and makes access to vital information a breeze, for both the company and the employees.

Accuracy

Save time and reduce the risk of human error by leveraging our solution to systematically upload contribution information from your payroll provider to our recordkeeping system.

Timely

Ensure your participants’ contributions are invested promptly, rather than being dependent upon an individual uploading a file to our website.

Secure

Have confidence in knowing your employee’s sensitive data is transmitted and stored securely with advanced encryption.

Integrate

With seamless communication between your payroll provider and our recordkeeping system, 401(k) contribution rate changes are automatically fed to the payroll system.

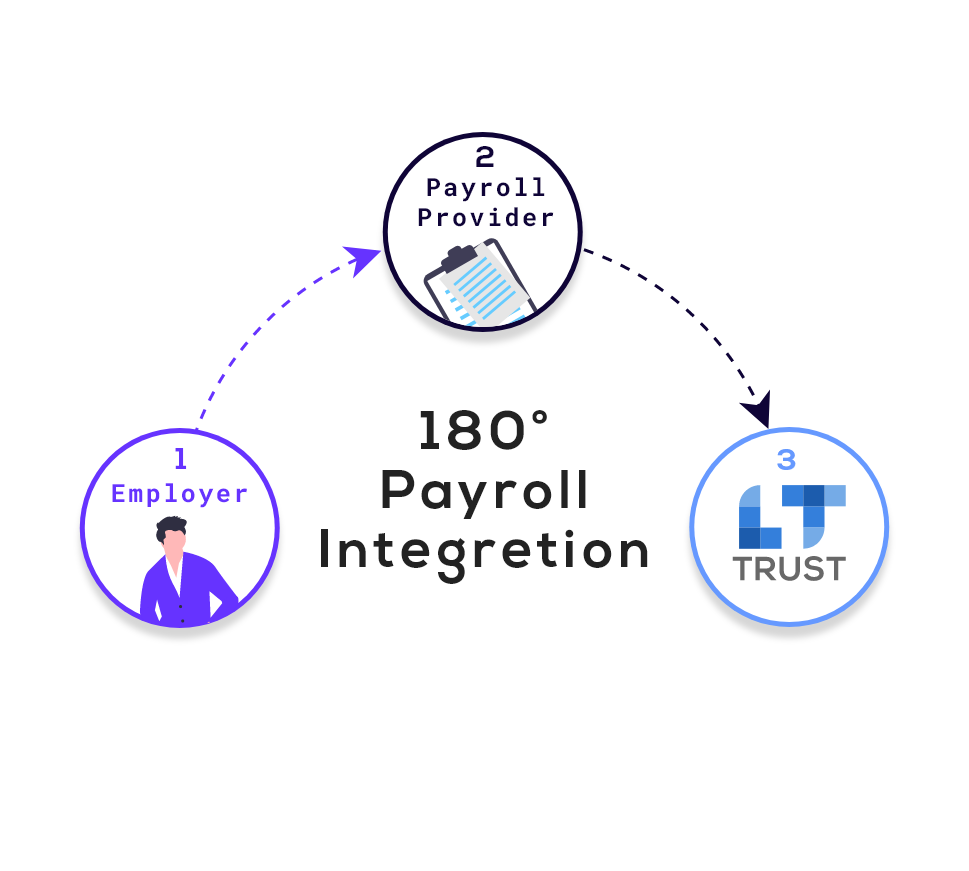

180° Payroll Integration

For 180° payroll integrations, the payroll provider will transmit payroll data to LT Trust each pay period. Participants who make changes to their contribution rate on the LT Trust website still require plan sponsors to update the payroll provider with the new information.

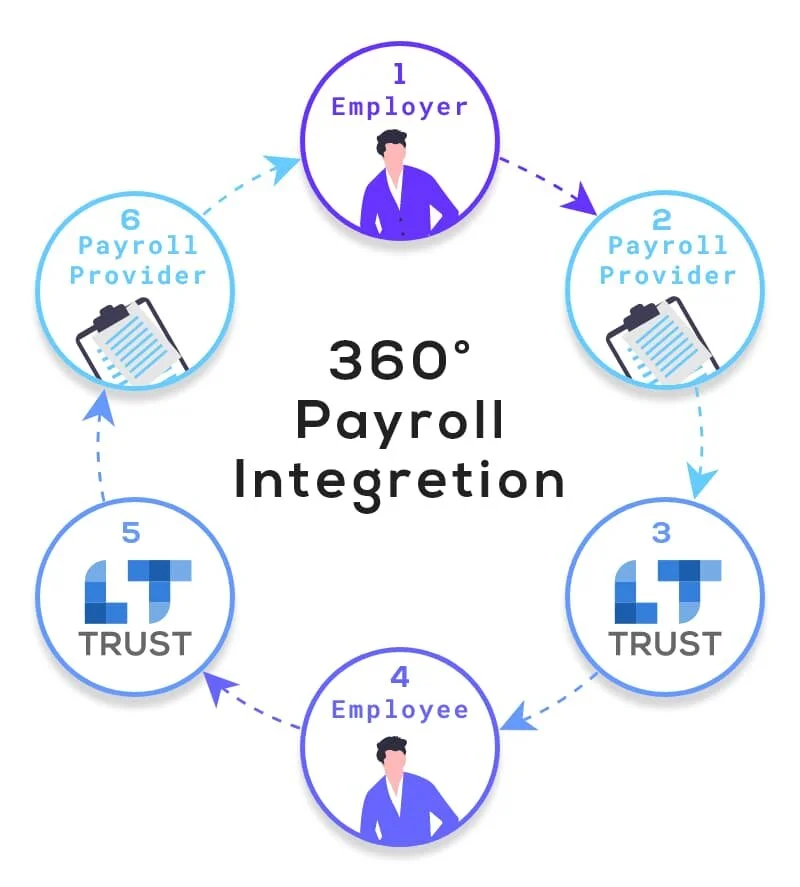

360° Payroll Integration

For 360° payroll integrations, the payroll provider will also transmit payroll data to LT Trust each pay period. In addition, LT Trust will transmit contribution rate changes made by participants on our website to the payroll provider as well.

LT Trust Payroll Partners

Take a look at LT Trust's payroll partners below.

180° vs. 360° Payroll Integration

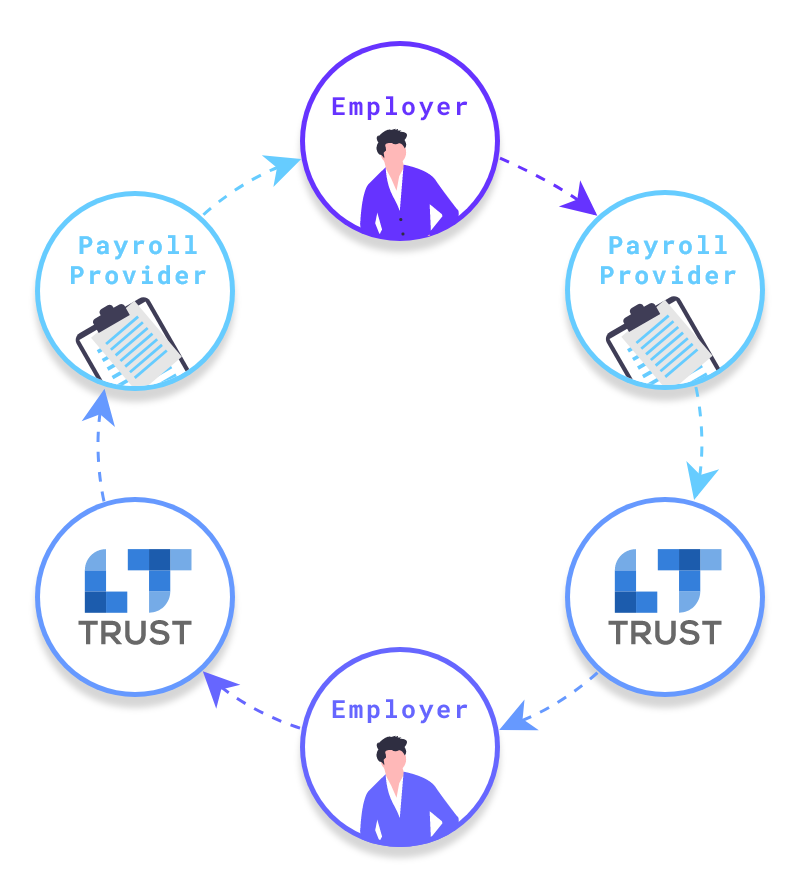

180° and 360° integrations both connect payroll data to provider systems. 180° partners send employee plan contribution data to benefit providers or record-keeping systems. At LT Trust, we refer to this as one-way connectivity. 360° partners, on the other hand, are considered two-way connectivity, and send the changes to the payroll system. Eliminating any work required from the plan sposnors.

Below is a list of current and future payroll providers that are and will be part of the LT Trust payroll integration solution:

| Company | 180° | 360° |

|---|---|---|

| Paychex 360 | ✓ | |

| ADP Run** | ✓ | |

| Source One Payroll | ✓ | |

| Optima Benefits and Payroll | ✓ | |

| UKG PRO formerly UltiPro* | ✓ | |

| ADP Workforce Now** | ✓ | |

| Paylocity | ✓ | |

| Workday* | ✓ | |

| QuickBooks Online** | ✓ | |

| Paycom* | ✓ | |

| Ceridian* | ✓ | |

| CAVU HCM | ✓ | |

| iSolved HCM "Coming Soon" | ✓ | |

| Paycor | ✓ | |

| Onpay | ✓ |

*Setup fee charged by the payroll provider; please inquire with your provider about the specific fee.

**Monthly service fees are charged by the payroll provider; please inquire with your provider about the specific fee.

Payroll Assist

We'll handle your payroll! If your payroll provider is not on the list above, they will be enrolled in "Payroll Assist". LT Trust will upload your recurring payroll contributions to our record-keeping system. Our automated quality control reports will then ensure transactional integrity. We'll securely import your employees’ data contribution amounts.

Help us help you, by giving us access to your payroll company. Just add us as a user at your current payroll provider, and we'll take care of the rest!

What are the Benefits of Integrating Payroll with your 401(k)?

+ Saves Time and Money

+ Reduced Errors

+ Compliance

+ Reduced Paperwork

+ Security

Payroll Made Easy with LT Trust

If you have a few minutes to learn more about our new payroll processing system or how other enhancements can support your existing clients and future prospects, please schedule a meeting with an LT Trust expert today.