Rollover an IRA to 401(k): When and How?

Since the beginning of the COVID-19 outbreak, we’ve been inundated with news about the progression of the virus and the recession of the economy. Many Americans are aptly concerned about their retirement savings, feeling like much of the progress they made over the last decade is slipping away.

The recent market sell-off may seem alarming but we can find comfort in the history of the markets. It shows us that all things are cyclical and we’ll likely see a return to good times before too long. Instead of making emotional investment decisions, now is a great time for retirement savers to revisit their long-term plans and make sure they’re still on track toward their retirement goals. Part of that could mean rolling over an old 401(k) or IRA into their current LT Trust 401(k). This is also referred to as trustee to trustee transfer. For the retirement saver who isn’t sure why a rollover makes sense, here are a few things to consider.

Consolidating for easier management

On average, Baby Boomers held 12 jobs before the age of 52, according to the U.S. Bureau of Labor and Statistics. Of course, investment objectives change over time and those who take retirement planning seriously realize the need to periodically rebalance accounts so that target weightings match current objectives. The task of money management can be daunting for those with multiple accounts held by multiple custodians. Simply put, a rollover could make responsible money management much easier.

Lower 401(k) fees mean more savings over time

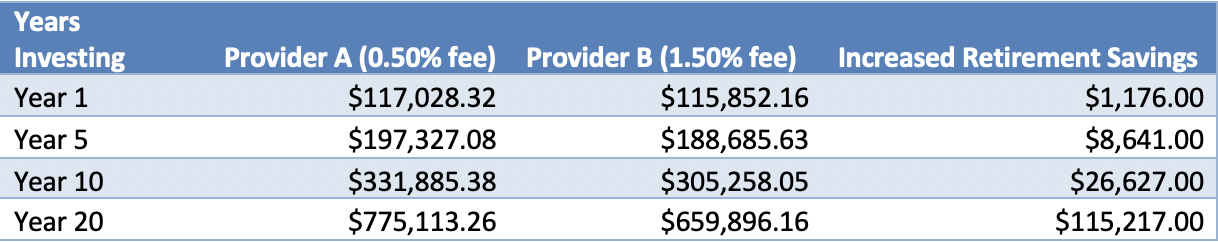

Fees are the great enemy during the accumulation phase. In fact, an additional 0.93% in fees could cost an investor $533,000 over the course of 40 years. For example, provider A charges 0.50% and Provider B charges 1.50% with an assumption of an initial $100,000 invested and an annual contribution of $10,000. The table below shows what that difference this can make.

Data and analysis from LT Trust, 2020

Fees should be a big decision factor when considering what to do with old retirement accounts. While performance history and management style is important to keep in mind when selecting funds, paying anything over 1% might mean it’s time to consider making a move. At LT Trust, our philosophy is that investors win when they have access to an open architecture 401(k) with upfront information about fees. We enable account holders and business owners to make the best decisions for themselves by having all of the information they need and being able to choose between 30,000 mutual fund and ETF’s.

Why rollover an IRA to a low-cost 401(k)?

Many of the reasons to perform a trustee to trustee transfer are similar to what we’ve discussed already, but also consider the added benefit of having earlier access to retirement funds under certain circumstances. Qualified withdrawals from a 401(k) can begin as early as age 55 if the owner becomes unemployed, voluntarily or not. The IRS prohibits IRA withdrawals until the age of 59 ½ unless the owner commits to taking at least one withdrawal per year for five years or until turning 59 ½, whichever comes last. In other words, an IRA owner may have to withdraw more than needed if taking withdrawals before age 59 ½. Conversely, if a retirement saver is still working late in life, like many are, they can postpone required minimum distributions from a 401(k) until after retirement, instead of having to begin at age 70 ½.

Other important factors to consider

401(k) loans, which should be used as a last resort, are not permitted in an IRA and are in a 401(k). Rolling your IRA to your 401(k) will increase your borrowing limit if you have under $100,000 in your 401(k).

Backdoor Roth and conversion: If you plan to convert traditional (pre-tax) money to Roth (after-tax) IRA money or make back door Roth contributions, you may want to minimize pre-tax money in your IRA. Doing so will neutralize the Pro-rata rule, which causes complications and taxes when you have pre-tax money in an IRA. By shifting that pretax money from your IRA to your 401(k), it will simplify things tremendously.

Among other things, ease of management, fees and withdrawal options are all things to consider when deciding if it’s the right time to rollover an IRA. Oftentimes, retirement savers will find that rolling over their other retirement accounts into a low-cost 401(k) is a move that will make it easier for them to achieve their investment goals.

Looking for more 401(k) and retirement readiness tips? Click below to subscribe to our blog so that you can read new posts as soon as they’re available!