CARES ACT: The Affects by COVID-19

Another 6.6 million people filed for unemployment benefits last week, according to the US Department of Labor. While many American families are struggling to pay their bills, some may decide to either borrow or withdraw from their 401(k).

The CARES Act was passed by Congress to provide economic relief in response to the COVID-19 pandemic. The new legislation created changes to both 401(k) loans and withdrawals. To be eligible for the new loan and withdrawal provision, the individual participant, or his or her spouse or dependent, must have been diagnosed with COVID-19, or the individual has suffered adverse financial consequences du to COVID-19.

401(k) Loan

The Cares Act now allows participants to borrow to the lesser of $100,000 or 100% of their vested account balance. This only applies to loans made on or before September 23, 2020 (180 days following enactment of CARES) and is only for individuals that meet the eligibility explained above. Loan repayments can be delayed for up to one year. Interest, which usually is around a point or two above the prime rate, does accrue during the delayed payback. The interest paid on the loan is deposited back into the 401(k) account.

Hardship Withdrawal

The CARES Act now allows participants to Withdrawal, penalty-free, up to $100,000 of their vested balance until December 30, 2020. Participants have three years from the day after the distribution to repay the amount into a qualified retirement plan. The distribution will be taxable if it is not repaid.

Factors to Consider

Taxes could be a major differentiating factor when it comes to deciding which option is best. For a withdrawal, the amount withdrawn will be taxed as ordinary income. A 401(k) loan avoids income tax if paid back in full through payroll deduction. Paying back a loan also reduces one’s take home pay. If a participant cannot repay the loan, it will become a taxable distribution

Psychology can play an important piece in this decision. A 401(k) loan automatically gets repaid through payroll deduction back into the 401(k). A withdrawal under the CARES Act allows participants manually to pay back the withdrawal amount within three years, but is not required. Having the decision whether or not to pay back the amount could be costly for one’s long term goals. Waiting the full three years to pay back the withdrawal, would mean missing out on potential market appreciation.

Plan design restrictions may limit loan availability. If a plan only allows one loan, taking a withdrawal will allow a participant to leave the loan option available for use if the need arises. A Plan Sponsor will also need to approve the new CARES ACT provisions.

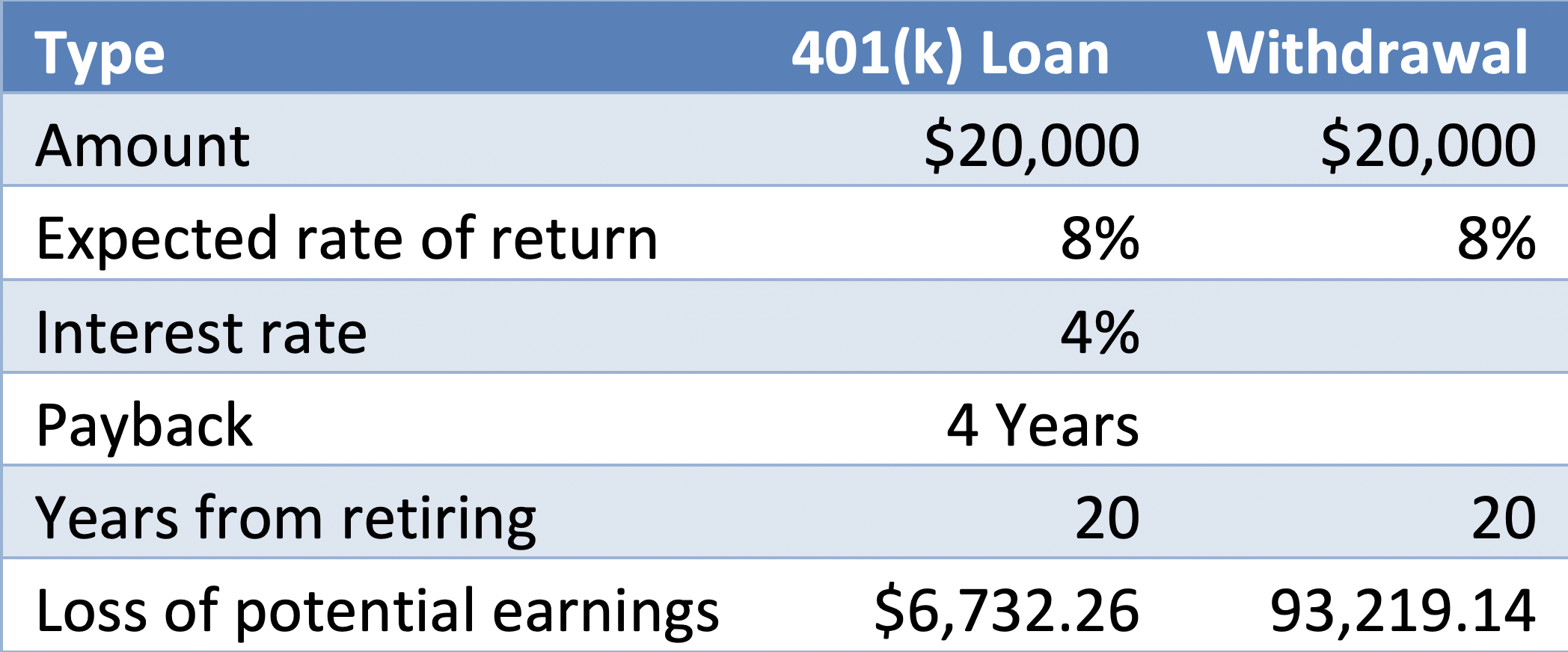

Before dipping into one’s 401(k), a participant should consider their overall long term savings goals. The loss of potential earnings is shown in the table to the left.

Whether you decide to borrow or withdraw from your 401k, LT Trust’s low-cost platform will allow you to make this decision without incurring excessive fees.

Some alternatives to taking money from your retirement may include:

a personal loan

home equity loan

dipping into personal savings